An insight of Student Loans

Simply put, student debt happens when a student uses a certain amount of borrowed money to cover educational costs that would not otherwise be covered by their assets, scholarships, grants, or parent-taken loans. The escalating fee structure of higher education has narrowed the possibility for students to take out the required sum from their savings.

Often students assume that after pursuing a higher degree from a reputed university, they will be able to land a job to repay the loan over time. However, there is no guarantee of finding such employment immediately after completing the degree course.

In this case, if the average tuition fee for a Master’s degree in Computer Science is $78,000 (excluding the living cost), then after postgraduation, one can end up in a debt of $100,000 with limited coding knowledge.

The student loan is interrelated to the increasing cost of tuition and college fees. On average, students from the top US universities have a debt of $22,957. Take a look at the top 10 universities and their corresponding average student loan in 2020:

| Sr. No. | University | Average Student Debt |

| 1 | Northwestern University | $32,395 |

| 2 | Brown University | $29,620 |

| 3 | Cornell University | $29,762 |

| 4 | Columbia University | $27,908 |

| 5 | Johns Hopkins University | $25,697 |

| 6 | University of Notre Dame | $27,686 |

| 7 | Massachusetts Institute of Technology | $22,696 |

| 8 | Rice University | $24,635 |

| 9 | Washington University in St.Louis | $22,555 |

| 10 | Vanderbilt University | $22,854 |

The vicious circle of student loans has many downsides. For instance, sometimes students incur debt but never really graduate, while some students take on more loans than they can afford to pay back. Also, most people incur loans at a young age, so they barely understand its implications.

Another downside of student debt is that it is difficult to discharge through bankruptcy and can only be done if you demonstrate undue hardship to yourself, such as being unable to maintain basic living standards.

Who gives the Student Loan?

Anyone can take a student loan from the federal government or private lenders who run student loan companies. Federal student loans have more flexible terms, income-driven repayment plans, & fixed interest rates, unlike private student loans. Here are the head-to-head differences between federal student loans and private student loans:

| Terms of Differences | Federal Student Loan | Private Student Loan |

| When loan payments become due | The loan payment isn’t due until you graduate from university or change your enrollment status to less than half-time. | Students need to pay while they are still in the university, but some private lenders do allow you to put off payments until you graduate. |

| Rate of Interest | The interest rate of federal student loan is fixed and often lower than the credit card rates. | Private loans do not have a fixed rate of interest and may vary lower or higher than federal loans based on the circumstances. |

| Credit Score Check | Students don’t need to get a credit check to become eligible for federal loan expect for PLUS loans. | Private student loans usually require a cosigner or an established credit score. |

| Subsidies | If you want financial aid, you may qualify for a student loan for which the U.S. government pays the interest until you complete your college on at least half-time basis. This loan is known as subsidized loan. | Private lenders do not provide a subsidized loan. Instead, they offers unsubsidized loan for which students are responsible for paying the loan interest by their own. |

| Repayment Plans | Federal loans have many student loan repayment plans like income-based payment in which you get an option to tie your monthly income to the loan payment. | The repayment plans in a private loan differ based on the lender’s terms and conditions. So you need to check with your lender to know about your repayment options. |

| Debt Consolidation | Federal student loans can be consolidated into a direct consolidation loan. | Private loans cannot be consolidated but may be refinanced. |

| Postponement of Loan | In case you struggle to repay your loan, you can temporarily lower your payments or postpone it. | Not all private lenders provide the postponement options, so you need to check with your lender. |

| Student Loan Forgiveness | If you work in public service, then you may become eligible to have some part of your loan forgiven. | There is no option of loan forgiveness given by private lenders. |

| Prepayment Penalties | The federal loan does not impose a prepayment penalty fee. | When taking a student loan from a private lender, you need to ensure if there is a prepayment penalty fee or not. |

Student Loan Crises in the United States of America

Several Americans are still recovering from the adverse impact of the Great Recession that shattered the entire economy. To curb the situation, many lenders introduced risky lending options like adjustable-rate mortgages, enabling borrowers to take higher loans than they could afford to repay. This step further resulted in default payments & ballooning debts.

Today, another crisis of student loans is looming in the country. With the increase in higher education, Americans are burdened by more outstanding student debt than ever.

The following statistical data depicts a clear picture of student loans in the United States:

- Currently, Americans owe a student debt of $1.78 trillion. That’s up 1.1% from 2022. Out of this, $127.2 billion is in private student loan debt.

- The largest lender of student loans in the United States is the US Department of Education which the federal government guarantees. In fact, 93.1% of the $1.78 trillion debt is in the form of federal loans, and the rest is owned by private lenders.

- Over $94.7 billion in loans were obtained by parents and students for the 2021–2022 academic year. Federal unsubsidized loans made up 46% of it, followed by federal subsidised loans made up 16%, Grad PLUS loans made up 13%, private loans made up 12%, and Parent PLUS loans made up 11%.

- 24% of borrowers who attended private, for-profit colleges and 7% of borrowers who attended private, nonprofit universities were in arrears on their loan payments, respectively.

- The average student loan debt in the US is $37,338 but total average debt (including private loan debt) may reach $40,114.

- At the start of 2020, 75.3 percent of private student loans were being repaid, while 20 percent were being postponed.

- 20% of all adults in America report having unpaid undergraduate student loans, whereas 7% report having unpaid graduate student loans.

- In the first quarter of 2023, 0.67% of student loans were 90 days or more past due.

- As of December 2022, 25.6 million students’ loans are in forbearance, making up 63.6% of the total amount owed on federal student loans.

Consequences of Student Debt

Student loans are the most common financing source for college aspirants, but the never-ending burden of student loan repayment lingers in their lives for years. Many people have to disrupt major life events such as getting married, buying a house, having children, or saving for retirement due to outstanding student debt.

Some student loan borrowers can afford to repay their debts in 10 years or less if the total amount of their debt is less than their annual income. Otherwise, the borrowers will struggle to repay their loans and will have to reduce their monthly student loan repayment by extending the term of the loan through an income-driven repayment plan.

Why Student debt has rapidly increased?

Let’s illuminate the reasons behind the increase in student loan debt:

1. Financial difficulty:

There are several challenges that student borrowers experience while paying down their loans, as most of them come from low or middle-income families. So, financial instability becomes a barrier to student loan repayment.

2. Higher education has become costly:

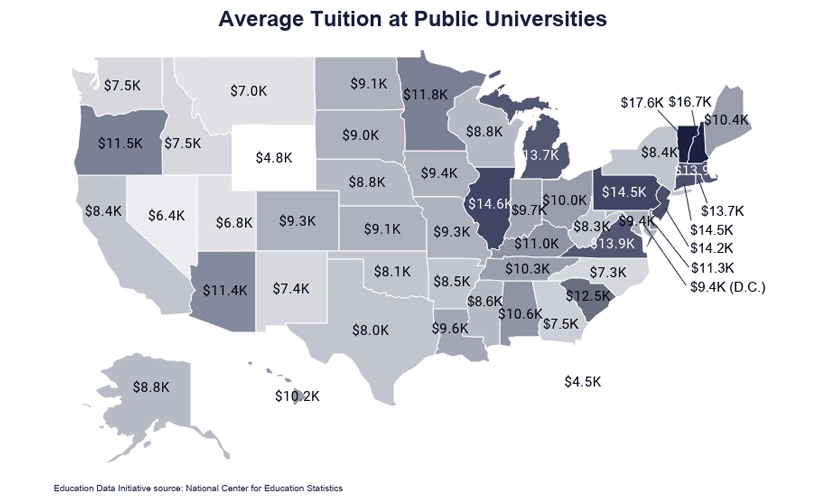

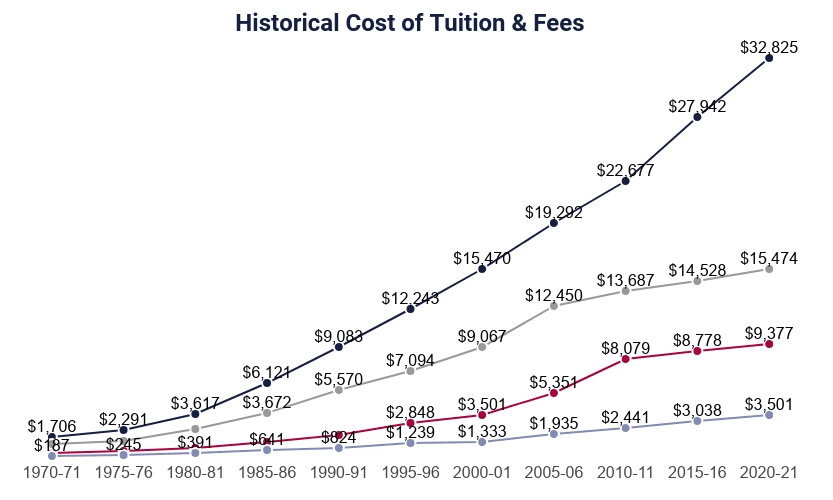

The tuition fees of colleges have inflated at a faster rate. If the annual fee of private and public colleges in 2010-2011 were $32517 & $15,919, then they raised to $46,313 & $21,337, respectively, in 2020-21. With a rise in college fees, there has been an equivalent rise in the student loan crisis. Some of the prominent factors that made colleges so expensive are:

- The sudden surge in demand for college degrees;

- A higher number of enrollments contribute to the expansion of financial aid;

- Colleges need more funds to pay experienced faculty;

- Lack of financial support from the government.

3. Not Getting Employment Opportunities:

Even after spending tons of money on pursuing a degree, new graduates cannot find a job due to their lack of real-time experience and required skills. Thus, they fail to make loan repayments and get overburned with thousands of student debts.

What Should Students Do?

To protect yourself from sinking under the constant pressure of repaying student debt, you must determine if getting a higher degree is worth it. Conduct market research to understand if college graduates could secure good jobs after completing the degree course or are still struggling to earn their living.

- Evaluate the scope of a degree and the corresponding amount of loan it may require.

- Also, look for substantial alternatives to a college degree that suits your pocket.

- Before directly enrolling in a college, it is essential for students to assess the prospective results they will get after completing a four-year degree. If it results in a vast amount of loan with a piece of paper, then it is definitely not worth it.

Higher education is becoming irrelevant as it does not provide students with the required knowledge, skills, & expertise to start their careers soon after graduation. Also, the outdated curriculum of degree courses fails to cope with the ever-changing demand of employers who look for top-notch candidates with specialized skills. Thus, college graduates do not get jobs and end up with big debts.

Conclusion

The current situation of the student loan crisis is horrifying & could adversely strike the US economy if no action is taken shortly. It calls for collective efforts from the state government, colleges, federal student aid, private lenders & students to mitigate the increasing risk of loan crisis.

Besides, students should stop following the crowd blindly and rely more on non-traditional methods of learning like coding bootcamp training. Instead of going for a degree, students should take skill enhancement training from the trusted coding bootcamps online to establish new skills which are in demand that can help them get lucrative career opportunities.

Also, Read our next blog Student Loan Crisis in the United States – The Solution

Anytime you want to upgrade your skills and need a helping hand to enter or reenter the tech workforce with high-demand tech skills, reach out to us compare Synergisticit’s Return on Investment as compared to Universities and Colleges and then join our Job Placement Program (JOPP). Since 2010 we have helped 10,000+ of jobseekers achieve success in the technology sector. SynergisticIT’s career-oriented training programs which are tailored towards Job placement are classified separately into Data Science/Data Analyst/ML/AI Job Placement Program and Java Devops FullStack Job Placement Program and are fast-paced providing quality Hands on learning, Project work and tech education preparing Jobseekers with top-notch skills for coveted tech roles in the industry. For getting startedwith your career in tech Reach out to us . SynergisticIT– Home of the Best Data Scientists and Software Programmers in the Bay Area!