Outsourcing and offshoring have reshaped the American workforce, especially in the tech sector. As globalization and digital transformation accelerate, technology companies increasingly turn to models that reduce costs and optimize operations by leveraging talent and infrastructure in lower-cost countries. These trends have sparked debate on how American tech jobs—especially in areas such as call centers, customer support, tech support, and software development—are impacted, raising questions about unemployment, job security, and U.S. economic resilience. Find out how Outsourcing and Offshoring affect the American Tech Sector and the Job market

This blog post aims to comprehensively explain what outsourcing and offshoring are, examine their historical and current effects on American tech employment, detail the practices of major corporations, and offer strategies for job seekers to prepare candidates for a changing talent landscape.

Defining Outsourcing and Offshoring: Key Concepts in Tech Globalization

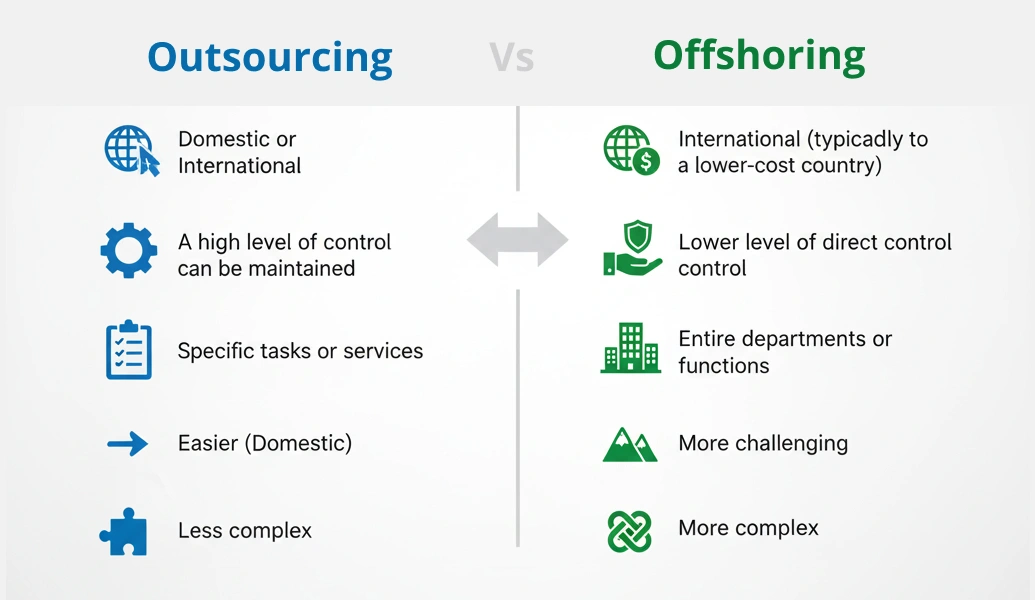

Outsourcing is the practice in which businesses delegate certain tasks, functions, or services to third-party companies, often specialized in those areas and sometimes located overseas or in a different city. Crucially, outsourcing can refer to both onshore (domestic) and offshore (international) contracts. On the other hand, offshoring is a specific form of outsourcing where the contracted activities, departments, or roles are moved to a foreign country, typically in pursuit of lower labor costs, greater efficiency, or access to specialized skill sets.

The difference, while subtle, is meaningful. An American company could outsource payroll processing to a firm in Texas, or it could offshore customer support to a partner in the Philippines. Offshoring is always international; outsourcing may or may not be. Both practices, however, are motivated primarily by the same goals: cost reduction, operational flexibility, and, increasingly, scalability in an unpredictable economic climate.

Historical Trends: The Rise of Outsourcing and Offshoring in U.S. Tech

The roots of outsourcing can be traced back to the late 20th century, but its significance in the tech industry grew dramatically from the 1990s onward with advances in IT, internet bandwidth, and telecommunication infrastructures. Businesses found they could maintain 24/7 service at lower costs by offshoring business processes to Asia, Eastern Europe, or Latin America.

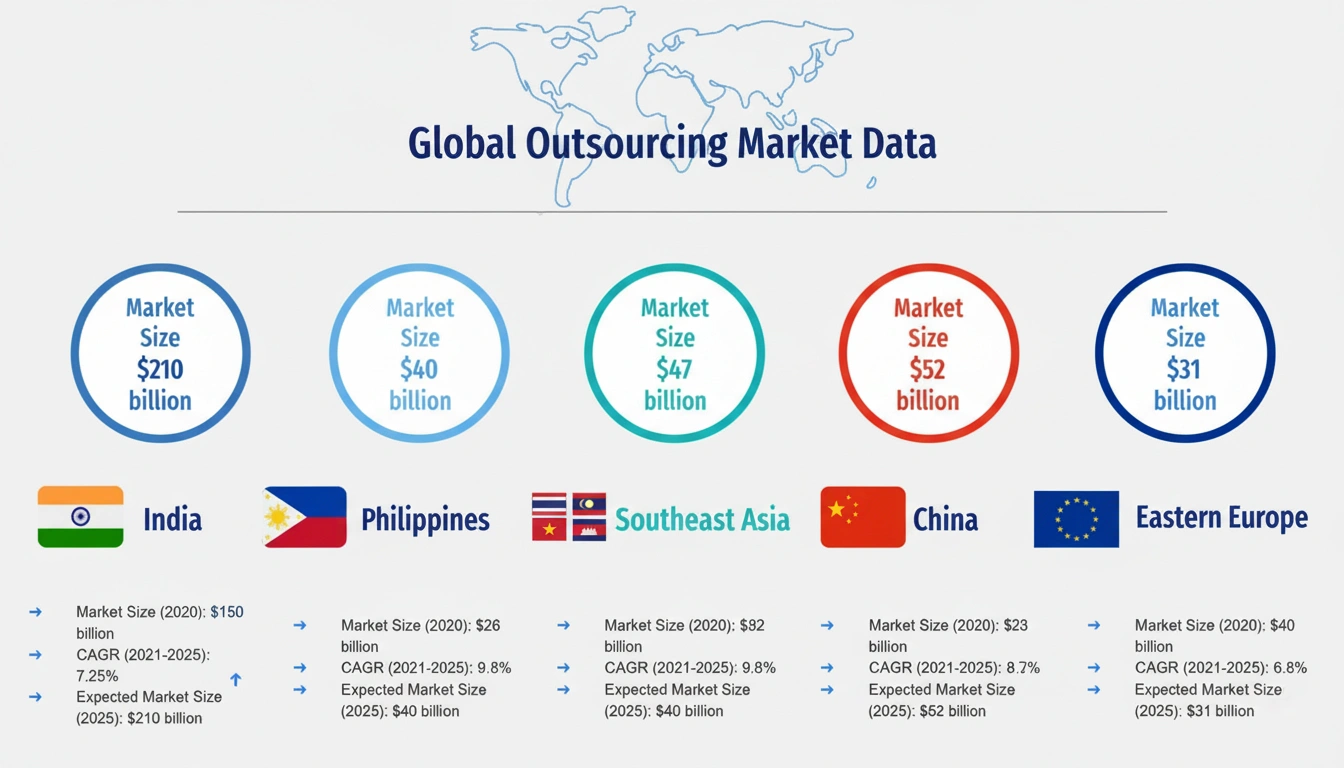

Call centers in India, the Philippines, and Eastern Europe proliferated as American companies sought to reduce the cost of customer service and technical support. In parallel, software development offshoring became popular, first to Russia, then India and China. The appeal was simple: an engineer in Bangalore or Krakow might cost a fraction of one in San Francisco, but provide similar productivity.

By the 2010s, with unified collaboration tools and cloud services, offshoring expanded from back-office or support roles to more complex areas, such as software engineering, product testing, and data analysis. The pace has only quickened with growing tech talent pools in cities like Bengaluru, Manila, Warsaw, and Guadalajara.

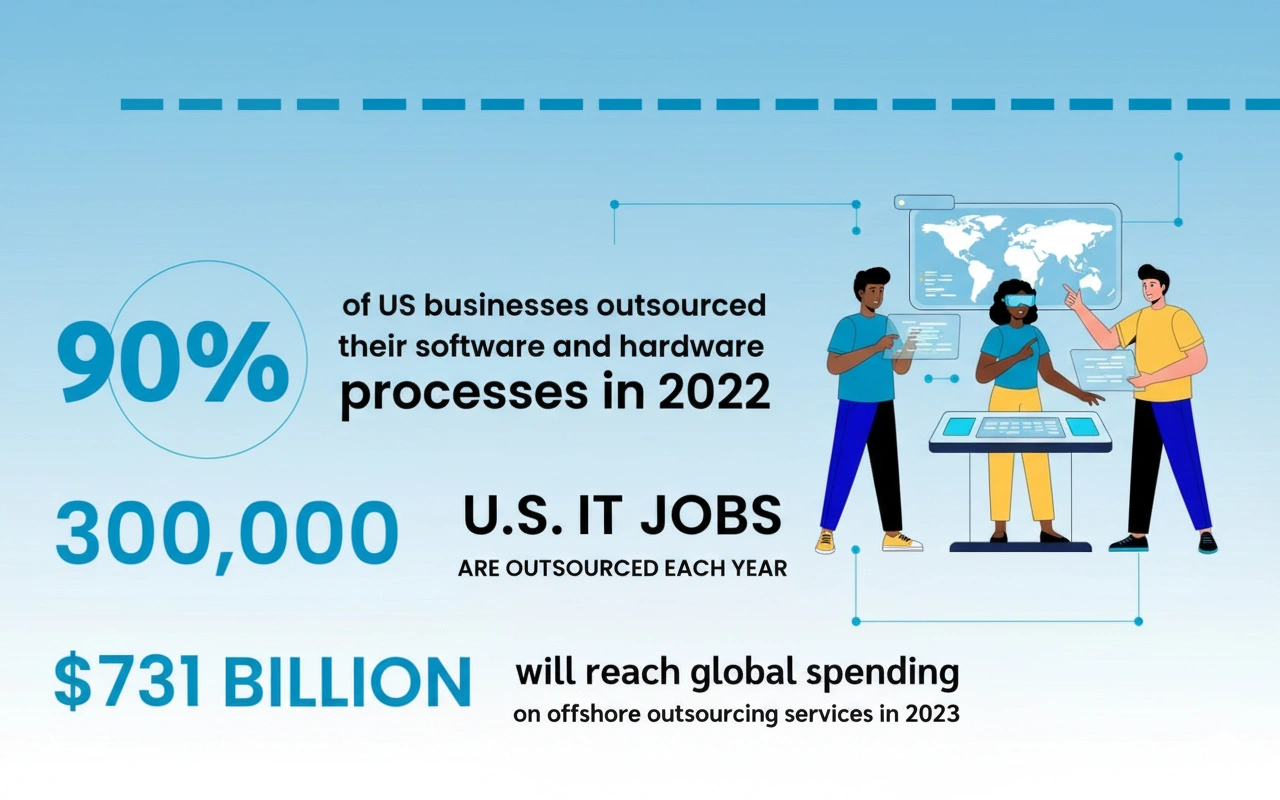

Data from multiple sources confirms the staggering scale of this shift. As of 2025, more than 60% of American tech companies leveraged offshoring for cost-heavy or easily commoditized tasks, up from just 30% in 2000. The top five destinations for U.S. offshoring in tech are India, the Philippines, China, Mexico, and Poland.

Outsourcing’s Impact on U.S. Employment: Trends, Realities, and New Pressures

The Effects on Low-Skill and Entry-Level Tech Jobs

Undoubtedly, one of the most controversial aspects of tech outsourcing and offshoring is its impact on low-skill jobs. Positions that require generalist skills—such as Tier 1 technical support, data entry, call center operations, and basic QA—are often the first to be relocated overseas. These roles, while requiring technical acumen and good communication skills, often do not demand deep technical specialization or U.S.-specific contextual knowledge.

According to a 2024 Forbes feature, as many as 350,000 U.S.-based tech support and call center jobs have been lost to offshoring over the last decade, with a majority shifting to India and the Philippines, where labor costs are 60-75% lower. One in five American companies admitted to directly replacing laid-off U.S. workers with offshore workers in 2024 alone, an alarming sign of how widespread this practice has become.

While these job losses are significant, it is important to recognize that automation and AI are also contributing factors in diminishing demand for entry-level technical roles; many companies now deploy chatbots and automated ticketing before escalating to offshore human agents.

The Effects on High-Skill Tech Jobs

While the lower and mid-skilled roles are most at risk, high-skill jobs—such as solutions architects, cybersecurity analysts, embedded systems engineers, and technical directors—remain largely U.S.-based. This is primarily due to regulatory requirements, the need for cultural fluency, client-facing responsibilities, and, critically, security concerns.

Forbes and USA Today both report that while thousands of lower-level jobs are continually offshored, the net demand for highly skilled U.S. workers remains high and even outpaces supply in key areas, including advanced software development, AI/ML engineering, and cloud infrastructure. Indeed, many chief technologists, principal engineers, and senior product managers continue to command six-figure salaries and strong job security domestically.

Economic, Social, and Psychological Pressures

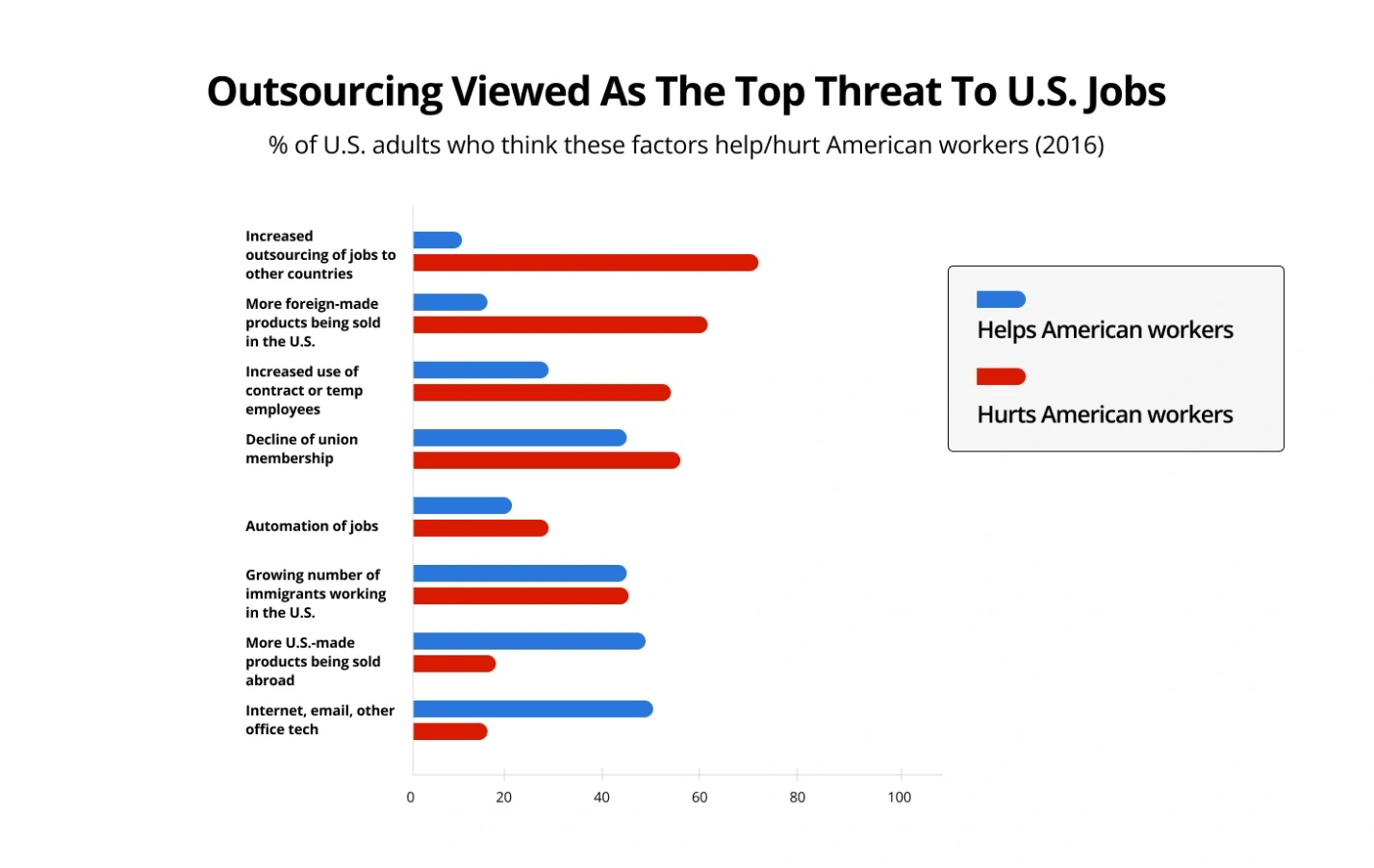

Beyond the statistics, American tech professionals face insecurity, stagnation, and sometimes the indignity of training their own overseas replacements—often a precursor to layoffs. This trend, sometimes called “knowledge transfer before termination,” is widely reported in news media and employee testimonials. The threat of job outsourcing creates a cycle of stress that can lead to lower morale, lower consumer spending, and even political activism for protectionist measures.

Case Study: Knowledge Transfer – Training Offshore Replacements

Perhaps one of the most demoralizing episodes for U.S. tech workers is being asked to “transition knowledge” to offshore contractors who will soon take over their jobs. This practice is not only widespread, but often incorporated openly into transition plans. For instance, a 2024 ResumeBuilder survey found over 20% of companies required outgoing U.S. tech employees to train offshore hires as a formal part of their offboarding process.

Numerous employee accounts detail how this knowledge transfer process is structured—a set of documentation tasks, live workshops, shadowing sessions, and Q&A calls with offshore hires. The process is often unsentimental and highlights the commoditization of highly routine tech work. This trend is especially prevalent in large consulting and tech service firms, as detailed later in this report.

Offshoring Focus Areas: Call Centers, Customer Support, Tech Support, and Software Development

Call Center Offshoring

The most visible symbol of outsourcing remains the offshore call center. American companies in telecommunications, finance, healthcare, and e-commerce have all established major call center presences in countries like India (Mumbai, Pune, Hyderabad), the Philippines (Manila, Cebu), and increasingly, Mexico and Central America.

A 2025 report by HugoInc estimates that over 70% of large companies in the U.S. outsource at least a portion of their call center operations—up from around 50% in 2010—with more than 40% of all customer support calls now routed offshore. The Keep Call Centers in America Act of 2025, proposed in Congress, underscores growing concerns about lost jobs, service quality, and data privacy.

Customer Support and Tech Support Offshoring

Customer support offshoring closely follows the call center trend, but includes a broader spectrum—from handling software troubleshooting and installations to guiding enterprise customers through complex technical workflows. Most Americans have likely interacted with an offshore tech support specialist or service agent, usually unaware of the global handoffs behind their queries.

The Philippines, now recognized as the “call center capital of the world,” employs more than 1.5 million workers serving American companies—outpacing India in voice-based customer support as of 2025. Major American firms, including Microsoft and Amazon, have significant support operations in Manila, Cebu, and Davao, handling everything from basic troubleshooting to advanced product support.

Software Development Offshoring

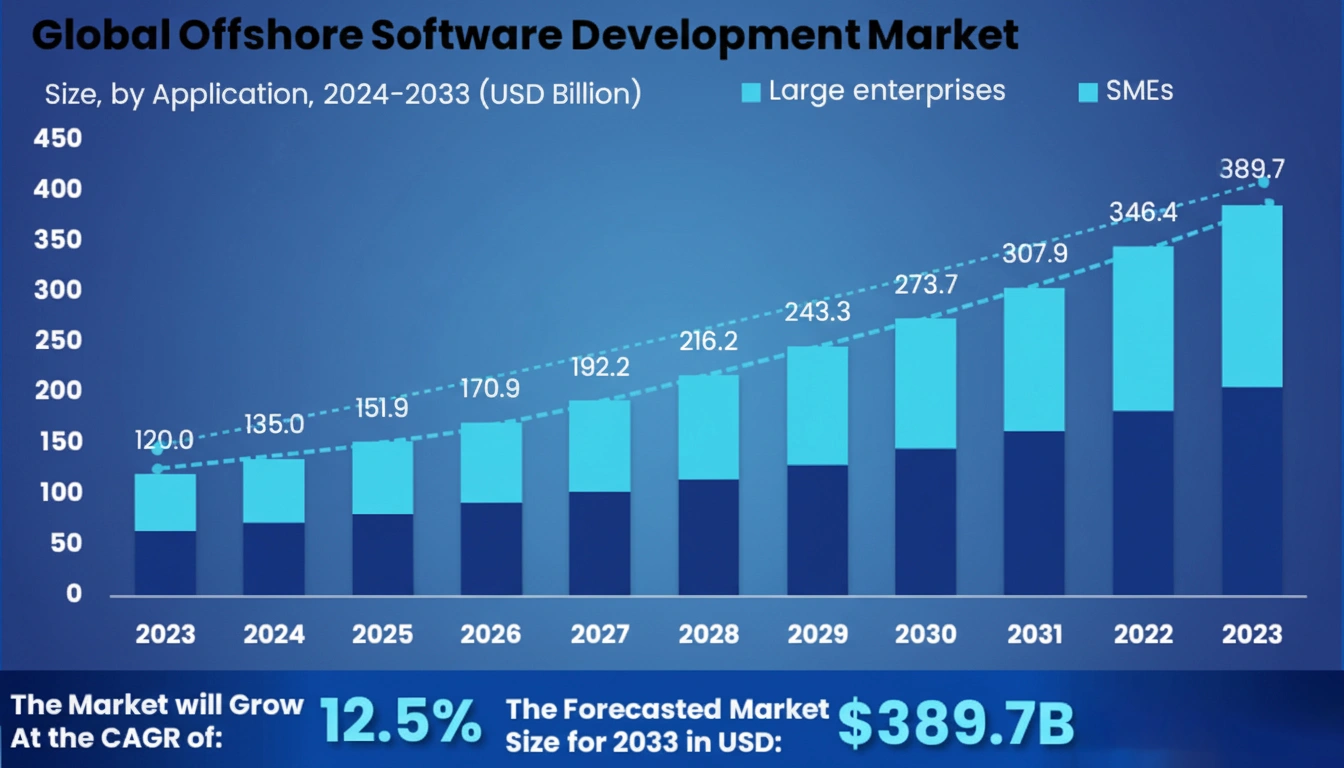

Software development is now the single largest segment of IT offshoring. Rather than just “help desk” work, companies increasingly rely on offshore teams for application development, testing, DevOps, and QA. Countries such as India, China, Ukraine, and Poland have developed entire IT cities and ecosystems centered around American contracts.

The numbers are striking: Between 2020 and 2025, the global offshore software development market grew from $110 billion to an estimated $145 billion, with U.S. companies representing the largest client base. According to recent data, up to 75% of Fortune 500 tech firms use offshore or “blended” software engineering teams, and the fastest growing outsourcing destinations include Vietnam, Colombia, and Romania.

Major Tech Companies and Offshore Operations: A Data-Driven Look

To fully understand the impact of outsourcing and offshoring on American tech employment, it’s crucial to examine the offshore operations, contracted workforce, and global employment strategies of the largest U.S. tech and consulting companies. The following table summarizes key employment data, offshore activities, and notable outsourcing facts for some of the most influential players.

Offshore Workforce and Outsourcing Details for Major Tech Companies (2024–2025)

| Company | Total Employees | Offshore/Foreign Employees | Major Offshore Locations | Outsourced Operations | Notable Practices |

| Apple | ~164,000 | ~60% (Asia, E. Europe) | China, India, Ireland | Manufacturing, support, IT, R&D | Foxconn/Asia for manufacturing, India for app dev, global customer support |

| Microsoft | ~221,000 | ~50%+ | India, China, Ireland | Customer support, R&D, IT services | Major dev centers in India (Hyderabad, Bengaluru), large global support teams |

| Amazon | ~1,540,000 | ~60% (global) | India, Mexico, Costa Rica | Call centers, AWS support, logistics | Global dev & customer support, AWS ops in India, Mexico, Philippines |

| Google (Alphabet) | ~182,502 | ~50,000+ offshore | India, Mexico, Poland | Software dev, support, data ops | Recently cut U.S. jobs, expanded India/Mexico workforces for core teams |

| Meta (Facebook) | ~67,317 | 35–40% overseas | Ire., India, Singapore | Data mgmt, IT ops, content review | Content moderation, data ops largely offshored |

| IBM | ~288,000 | ~66% offshore | India, Philippines | Consulting, support, dev, cloud | More employees in India than in U.S. as of 2023 |

| Cisco | ~84,900 | ~40% non-US | India, China, East EU | Support, software dev, R&D | Large R&D centers in India, support ops offshore |

| Oracle | ~164,000 | ~55% (est.) | India, Romania, China | Product dev, support, BPO | Active outsourcing to India for support, also Mexico, Asia |

| Intel | ~124,800 | ~40,000 international | Malaysia, Israel, Ire. | Mfg, R&D, support, chip design | Chip plants and R&D in Malaysia, Israel, Ireland |

| HP | ~58,000 | ~52% offshore | India, Malaysia, Costa Rica | Dev, support, BPO | Major back-end operations and support in India, others |

| Accenture | ~743,000 | >72% offshore | India, Philippines, LatAm | Consulting, IT services, BPO | Largest contingent in India (>250K employees) |

| TCS | ~616,171 | ~98% India + global | India, LatAm, Europe | Software dev, consulting, IT mgmt. | 71% in India, huge presence in Europe, Americas |

| Cognizant | ~347,700 | ~75% offshore | India, Philippines | IT consulting, business process | ~235K in India, large onshore-offshore blend |

| Wipro | ~240,000 | 82% India/global | India, Americas, Europe | IT, consulting, support | Extensive offshoring, North America <14% |

| Infosys | ~346,000 | 88% India/global | India, US, Europe | IT dev, consulting, BPO | Only ~37,000 in Americas, rest in India/global |

The data in this table expose the extent to which American tech giants and major global consultancies have embraced offshoring as an integral element of their business models. Apple, Amazon, and Microsoft all maintain massive offshore offices—not only for call centers and basic support, but also for R&D, product localization, and application development. For companies such as IBM and Oracle, offshore employees have come to outnumber U.S.-based staff.

Among consulting giants, the trend is even more dramatic. Accenture, TCS, Cognizant, Wipro, and Infosys employ the overwhelming majority of their workforce outside the U.S.—primarily in India and other developing nations where labor costs are much lower. These firms act as major suppliers of outsourced and offshored labor for Fortune 500 clients, acting as intermediaries in the global labor chain.

Importantly, most of these organizations report record profits and continued expansion of offshore capacity, even as they tout “global diversity” or “workforce reinvestment” schemes in the U.S. The message is clear: cost optimization remains the priority.

Outsourcing in Action: How Consulting Giants Reshape the American Tech Job Landscape

Consulting companies such as Accenture, IBM, TCS, Cognizant, Wipro, and Infosys play a pivotal role in the offshoring ecosystem. Their business model involves winning large transformation or IT contracts from American companies, then delivering those services using vast overseas labor pools.

- Accenture: Employs over 250,000 in India alone, with another 200,000+ in other global locations. Its U.S. workforce (about 55,000 as of 2025) focuses primarily on client-facing, high-value work, while bulk delivery occurs offshore.

- IBM: Shifted thousands of tech support and software engineering roles to India and the Philippines since the 2010s. Indian staff now outnumber U.S. employees within IBM as of 2025.

- TCS (Tata Consultancy Services): Of over 616,000 global employees, more than 71% are based in India. TCS delivers complex IT projects, software maintenance, and even digital transformation services to U.S. clients using this massive offshore workforce.

- Cognizant, Wipro, and Infosys: All three rely on India for the bulk of their headcount and operations, with U.S. roles focused more on sales, client management, and solution design.

A widely documented practice is the “two-team” model, where vendors have a small U.S.-based liaison group working with the client, while a much larger “shadow” or “pod” of engineers sits in India or another low-cost location. U.S. client companies often request that their outgoing employees “onboard” or “knowledge transfer” during handoff, which has drawn criticism and sparked negative headlines. This cycle is a source of legitimate concern for American workers—but also a reality that now defines the global tech ecosystem.

The Other Side: How Tech Companies Justify Outsourcing

The widespread adoption of outsourcing and offshoring is not merely cynical cost-cutting. Tech companies argue, with some justification, that these practices yield significant benefits: lower labor costs, increased operational flexibility, continuous “follow-the-sun” support, and the ability to scale rapidly for global launches or seasonal peaks.

For shareholders, the upside is seen in higher profit margins and increased competitiveness.

Many executives point out that offshoring can direct domestic capital to high-value activities—R&D, core platform development, or advanced security—rather than commoditized or routine tasks. Favorable currency differences, specialized skills, and established offshore consulting networks further sweeten the deal. In a business environment that increasingly prizes agility, outsourcing has become not just a financial tool, but a strategic imperative.

However, as subsequent sections detail, these benefits are not without significant risks and long-term tradeoffs.

Risks of Outsourcing: Economic Dependency, Lower Work Quality, IP Theft, and Data Security

The economic case for outsourcing is strong, but the risks are equally significant and sometimes underappreciated. These include:

1. Lower Quality and Communication Breakdowns

Offshore teams may lack specialized domain knowledge, context, or “in the trenches” experience with American customers. Language barriers, cultural mismatches, or time zone issues can degrade service quality and lead to costly errors or customer attrition. Several high-profile outages and quality incidents have been traced to over-reliance on offshore support.

2. Intellectual Property (IP) Theft

Relocating high-value engineering or product work overseas heightens the risk of IP theft and leakage. Studies estimate that U.S. companies lose upwards of $50 billion a year to IP theft, with a significant portion tied to weak legal protections or enforcement in certain offshore destinations. Once proprietary source code, customer data, or system designs leave U.S. soil, recourse can be limited. High-profile legal battles have involved offshore staff or rogue partners leaking designs or cloning products.

3. Data Security and Legal Compliance

Sensitive customer or enterprise data, if handled abroad, may be subject to weaker privacy laws, government surveillance, or unpredictable regulatory regimes. The risk of data breaches or cyberattacks can increase, especially as sophisticated hacker groups exploit offshore vulnerabilities. Companies are also exposed to legal risks if they run afoul of American or international data localization mandates.

4. Economic Dependency and National Security

Heavy reliance on offshore labor, particularly in critical infrastructure domains or with single-country concentration (e.g., all engineering in India or manufacturing in China), makes American businesses and the broader economy vulnerable to geopolitical shocks, supply chain disruptions, pandemics, and political strife.

Selling to American Consumers While Outsourcing Jobs: The Ironic Cycle

A topic that fuels political and economic debate is the fact that tech companies earn the majority of their revenue from American consumers, while outsourcing jobs to overseas workers. The U.S. market remains the largest, most lucrative source of sales for Apple, Amazon, Google, and Microsoft. Yet, the support, development, and even part of R&D have been shifted—and profit margins boosted—by leveraging lower labor costs globally. This dynamic has led to growing calls for regulations to limit the percentage of jobs outsourced or offshored by tech multinationals.

In effect, some argue, American consumers are “funding their own unemployment” as the very companies they support shift wages and opportunity dollars overseas. This contradiction sits at the heart of the contemporary outsourcing debate, raising urgent questions about economic sustainability, income inequality, and corporate responsibility.

Current and Proposed Regulatory Frameworks: Can Outsourcing Be Controlled?

In response to growing apprehension over job losses, several legislative initiatives and policy debates have emerged aiming to regulate or limit the extent of offshoring. Regulatory tactics include:

- Disclosure Requirements: Companies may be required to disclose the percentage of jobs outsourced or offshored, especially when bidding for government contracts.

- Tax Penalties or Incentives: Penalties for firms that offshore American jobs, along with tax incentives to encourage domestic hiring.

- Job Transfer Notification Laws: Ensuring transparency to workers and communities when mass layoffs are linked to offshoring.

- Protected Roles: Mandating that certain critical or sensitive functions (cybersecurity, infrastructure) not be offshored.

The “Keep Call Centers in America Act of 2025” represents a legislative attempt to both track outsourcing practices and penalize firms that relocate call center jobs abroad. Technology sourcing laws and regulations in the U.S. are also evolving, focusing on data security, privacy, and anti-offshoring provisions for defense or sensitive critical industries.

Despite these moves, enforcement is patchy, and multinational companies often find legal workarounds or leverage the H-1B visa system as a transitional step before offshoring entire units overseas. As global work arrangements become standard—and corporate lobbying remains intense—meaningful, enforceable caps on outsourcing remain rare in most private-sector domains as of 2025.

Retention of Critical and High-Paying Tech Jobs in the U.S.: Silver Linings and Security Realities

Despite the high-profile loss of lower-skill jobs, the overwhelming majority of critical high-paying tech roles remain in American hands. The reasons are multifold:

- National Security and Data Sensitivity: Jobs involving the design of secure cloud infrastructure, defense contracts, proprietary algorithms, or confidential customer data remain U.S.-based to satisfy both regulatory requirements and client trust.

- Client-Facing and Context-Sensitive Roles: Jobs that require intensive collaboration, nuanced cultural understanding, and on-site presence (such as solutions architects, product managers, UX leaders) are recruited mainly within the U.S.

- Access to the World’s Deepest Tech Ecosystem: Silicon Valley, Seattle, New York, and Austin continue to attract and retain top global tech talent, in part because they offer the highest compensation and the most advanced platforms.

As a result, most “mission-critical,” leadership, and architect roles that command six- and seven-figure salaries remain within the U.S. For jobseekers able to acquire relevant skills, certifications, and experience, the American market still offers abundant opportunity.

SynergisticIT: Turning Outsourcing Fears into Job Market Readiness

With outsourcing and offshoring trends largely outside the control of most jobseekers, future-ready candidates must focus on differentiation, upskilling, and proactive adaptation. This is where programs like SynergisticIT’s job placement program become so impactful.

SynergisticIT Job Placement Program: Overview and Value

SynergisticIT is dedicated to helping tech jobseekers break into the American tech workforce—even amidst the challenges posed by offshoring—by combining market-relevant technical training, industry certifications, and crucial job placement support. Their job placement program is designed for software engineers, Java developers, data scientists, DevOps engineers, and others aiming for in-demand U.S. tech roles.

Key highlights:

- Personalized career counseling and interview coaching

- Real-world project experience in high-demand tools and stacks

- Industry certification preparation (Java, AWS, Data Science, etc.)

- Direct employer connections and job placement assistance

- Support in resume optimization and salary negotiation

Specialized Java and Data Science Job Placement

For those targeting high-demand skillsets, SynergisticIT offers specialized tracks such as its Java/DevOps/Full Stack program and Data Science Job Placement Program. These programs focus on core fundamentals as well as advanced frameworks, ensuring that graduates can compete for domestic roles—especially those less vulnerable to offshoring.

Real-World Visibility and Industry Recognition

SynergisticIT’s success is recognized in publications like USA Today, which highlights the company’s innovative approach to tech workforce readiness and its partnerships with top employers. Notably, SynergisticIT helps overcome biases linked to “just-in-time” offshore hiring by offering vetted, job-ready local candidates.

Interview Questions, Event Videos, and Blogs for Jobseekers

Preparation is critical in today’s competitive market. SynergisticIT offers comprehensive resources, including:

- 3000+ Technical Interview Questions and Answers: Spanning Java, Python, AWS, React, Data Science, and more.

- Gallery and Event Videos: Job fair clips, alumni stories, and employer panels for networking and insight.

- Educational Blogs: Covering career trends, interview strategies, and ways to stand out in a global applicant pool.

These accessible materials ensure candidates are not only technically adept but also confident and ready to navigate complex interviews and evolving job descriptions.

SynergisticIT’s Case Studies and Graduate Outcomes

SynergisticIT boasts hundreds of successful job placements across Fortune 500 firms, mid-market companies, and innovative startups. Alumni frequently report that SynergisticIT’s mock interviews, technical assessments, and real-world project simulations gave them the decisive edge required to secure domestic roles—even for companies with significant offshore operations.

For instance, SynergisticIT has worked with graduates to secure placements at U.S.-based positions at Amazon, Google, and IBM, as well as successfully coach candidates transitioning from roles threatened by offshoring to higher-value, U.S.-anchored jobs.

Strategies for American Tech Jobseekers: Thriving Despite Outsourcing and Offshoring

Outsourcing and offshoring are enduring features of the tech economy. For jobseekers, the key is readiness, adaptability, and pursuing career paths less sensitive to global labor arbitrage.

Actionable strategies include:

- Pursue Advanced and Specialized Skills: The more advanced or domain-specific your expertise (AI, cybersecurity, DevOps, cloud, product management), the lower your offshoring risk, and the higher your earning power.

- Develop Soft Skills and Client Communication: U.S. employers highly value candidates who can engage with clients, explain complex ideas, and work cross-functionally across departments—skills harder to offshore.

- Stay Informed on Industry Trends: Regularly reading industry publications (e.g., USA Today), participating in webinars, and following thought leaders will help you spot emerging “hot” skills and avoid those on the decline.

- Leverage Local Placement Programs: Partner with proven job accelerators like SynergisticIT to access expert coaching and job-matching services.

- Network Relentlessly: Attend virtual and live job fairs, alumni events, and online forums (SynergisticIT events) to expand opportunities beyond what is posted online.

- Prepare for Outsourcing-Related Interview Questions: Anticipate questions regarding previous experience working with global teams, knowledge transfer situations, or strategies for “bridging” onshore-offshore collaboration (SynergisticIT’s interview bank).

- Seek Continuous Upskilling: Stay current in emerging frameworks, certifications, and cloud platforms, especially as technology cycles grow increasingly compressed.

By focusing on these strategies, tech jobseekers can not only weather but thrive in a marketplace shaped by global forces.

Conclusion: A Resilient Outlook for U.S. Tech Talent

The globalization of tech labor through outsourcing and offshoring is an undeniable reality in 2025. While it has resulted in significant job losses in commoditized and low-skill positions, the American market retains a robust demand for highly-qualified, domain-specific technologists. The most vulnerable roles continue to shift overseas, but high-value, critical, and leadership positions overwhelmingly remain in the hands of U.S.-based professionals who continuously upgrade their skills.

Rather than succumbing to anxiety, American tech workers and jobseekers should view outsourcing as a catalyst for upskilling, career adaptation, and targeted networking. Companies like SynergisticIT are invaluable partners in this process, offering tailored programs, mentorship, and direct pipelines to the roles that remain firmly anchored on U.S. shores. Their Java and Data Science programs provide focused pathways to job readiness for the fastest-growing and most resilient IT domains.

For those worried about the future, remember: as long as you align your skills with industry requirements, stay adaptable, and proactively build your professional brand, there are—and will remain—significant opportunities in the American tech economy. Prepare diligently, leverage expert guidance (blogs, events), hone your technical and soft skills, and you’ll remain competitive for roles that cannot be easily outsourced or offshored.

So don’t let global labor shifts overwhelm you. The right training, preparation, and mindset ensure that you can secure your place in America’s thriving tech sector—even in an age of outsourcing.